BDB launches special product for export-oriented companies

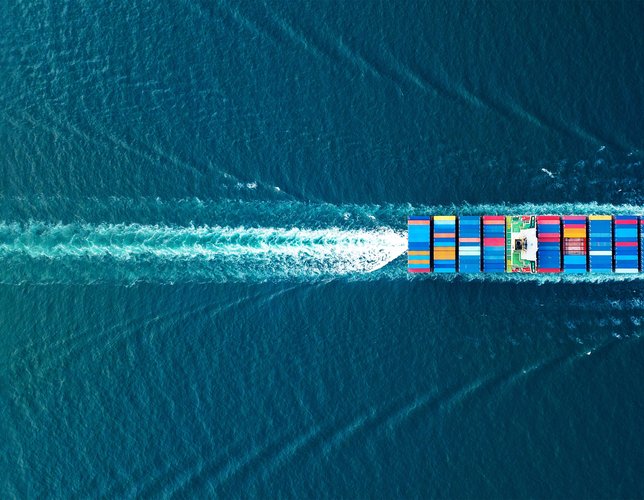

The Bulgarian Development Bank (BDB) is launching a new export finance product aimed at supporting Bulgarian manufacturers exporting their goods and services to international markets.

The specially designed programme is tailored to the needs of different sectors, with the bank aiming to provide companies with the necessary resources to achieve sustainable growth and expand their international presence.

Companies should have at least three completed financial years, positive equity and a clear export vision. They can count on support to finance key stages of export activity, from certification and production to logistics and market expansion costs.

Small and medium-sized enterprises can benefit from working capital loans to provide them with the necessary capital for production and exports. The loans will cover up to 100% of the costs incurred, but no more than 80% of the value of the export contract awarded. The funds can be for the purchase of raw materials, materials, electricity, wages and other items necessary for the production, sale and transport of a product or service. The maximum term of the loans may be up to 5 years with a review every 12 months.

The BDB will also provide companies with investment financing to expand production capacity, upgrade equipment and improve their competitiveness in international markets. The loans will cover up to 90% of the projected project costs and have a maximum term of up to 10 years.

Export companies can also apply for a letter of credit discount line. It will allow companies to more easily manage their cash flow by receiving the letter of credit funds upfront, ensuring better liquidity.

For companies with more than 80% of export revenues in the last two years or for individual export transactions, the loan amount may exceed BGN 5 million depending on the financing need in the specific case, but after analysis by BDB.